why is actblue not tax deductible

Along the way the issue of actblue there was a link on tyts site came up and i wanted to know why donations are not tax deductible. Charity Navigator does not currently.

![]()

Are My Donations Tax Deductible Actblue Support

An individual can contribute as much as 36500 73000 per couple per calendar year to the DCCCs general fund for use at the.

. If youve saved your information with ActBlue Express your donation will go through immediately. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are. Paid for by ActBlue Civics.

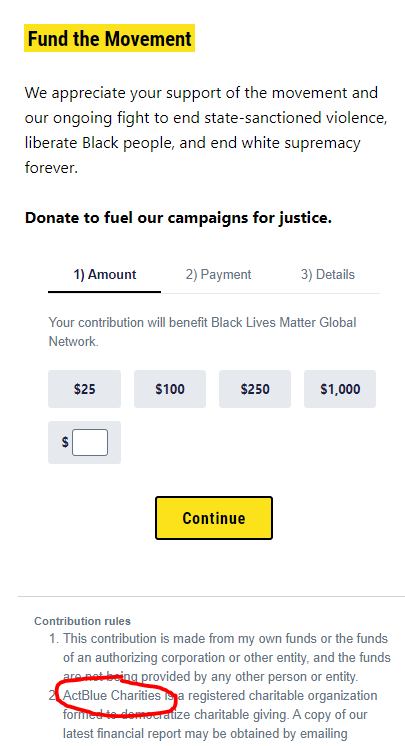

Why Is Aclu Not Tax Deductible The. But because ActBlue operates as a legal conduit a federal political committee that. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes.

About ActBlue Other Are my donations tax deductible. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online. Eight Tips for Deducting Charitable Contributions 1.

Why is actblue not tax deductible Monday June 13 2022 However donations to ActBlue Charities and other registered 501 c 3. I am making this contribution with my own personal credit card and not with a corporate or business credit card or a card issued to another person. Contributions or gifts to EMILYs List or endorsed candidates are not tax deductible.

ACTBLUE CIVICS INC is a 501c4 organization with an IRS ruling year of 2013 and donations may or may not be tax-deductible. If ActBlue is non-profit and nearly ALL the money. Social welfare donations are not tax deductible as charitable contributions.

We process and send grassroots donations to. If your goal is a legitimate tax deduction then you must be giving to a qualified organization. Well - this is from the IRS.

Contributions or gifts to the DCCC are not tax deductible. Paid for by Committee to Elect. Theres just a 395 processing fee on all transactions.

ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent. The following information will help you determine.

Michael Pernick Attorney Naacp Legal Defense And Educational Fund Inc Linkedin

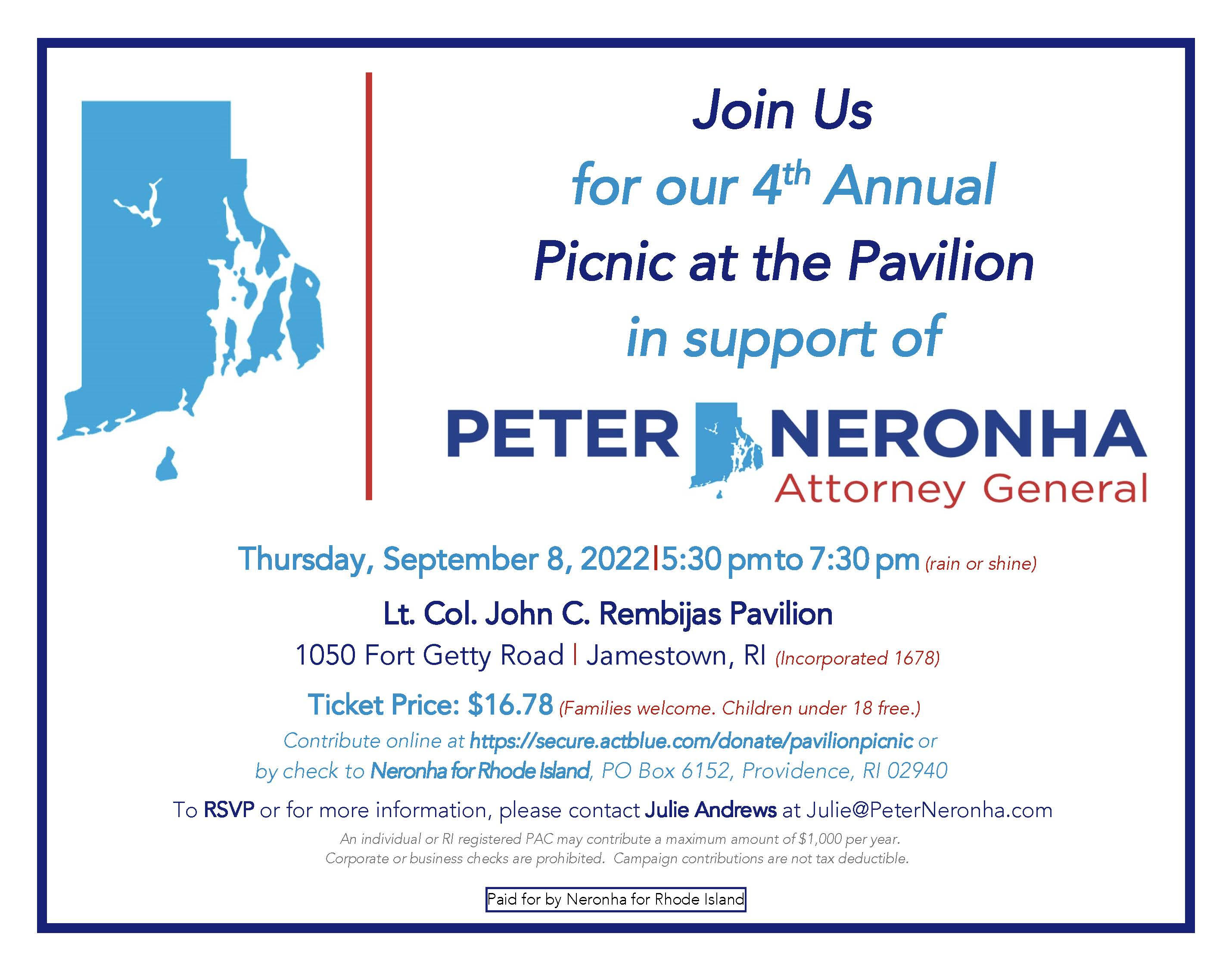

Ri Democratic Party Ridemparty Twitter

Frequently Asked Questions Everytown

Naacp On Twitter Tomorrow Is Givingtuesday And We Ve Set An Ambitious Goal To Raise 100k By Midnight On December 1st That S Why We Are Calling On You Make A Generous Tax Deductible Donation

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

What The Hell Is Actblue And Why Is It Showing Up On So Many Democratic Candidates Campaign Finance Reports Minnpost

Are My Donations Tax Deductible Actblue Support

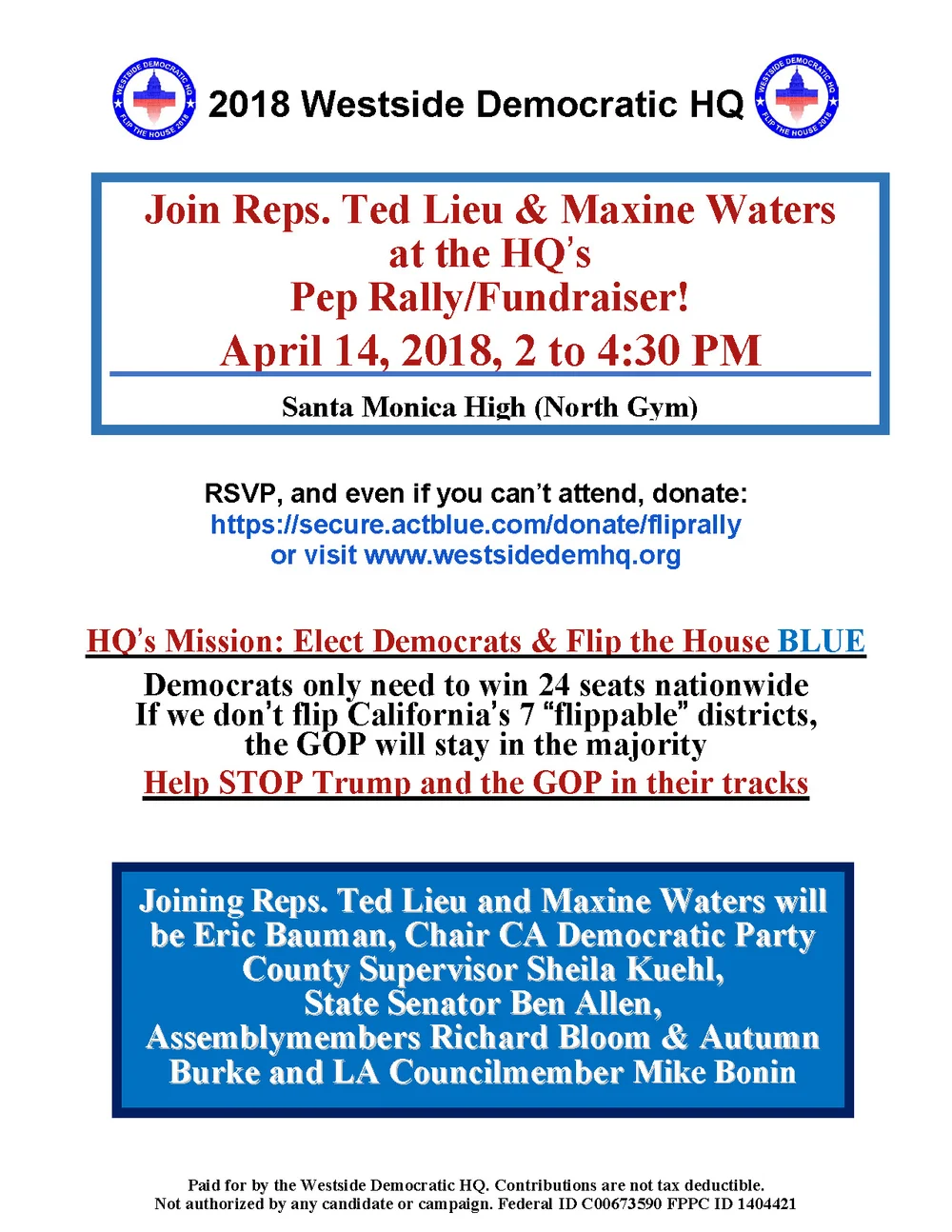

Surf The Blue Wave Grassroots Democrats Hq

California Energy Commission Chairman To Discuss Path To Clean Energy Future Piedmont Exedra

Westside Democratic Hq Pep Rally Fundraiser Westchester Playa Democratic Club Los Angeles Ca

Events Bobby Scott For Congress

Actblue On Twitter Rajwebshar Jaffer22915438 Tulsigabbard Sure There S A 3 95 Processing Fee On Contributions Actblue Is A Nonprofit And We Don T Keep Any Part Of The Donation For Ourselves We Re Legally Required

Actblue The Left S Favorite Dark Money Machine Capital Research Center